The clean energy transition is happening now.

Green banks and other clean energy finance programs play a big role in this transition—driving economic growth, creating jobs, and making energy upgrades more accessible and affordable for the people and institutions that power our communities.

Launching and scaling these programs takes expertise and support. That’s where Public Sector Consultants comes in.

Get a jumpstart on green bank activation.

Your green bank partner

Public Sector Consultants has been meeting challenges head on and driving impactful solutions for almost 50 years. Fifteen years ago, we built the nation’s first nonprofit green bank, Michigan Saves, and continue to shape the future of clean energy finance across the country. As the incubator and strategic advisor for several green banks, we know experience matters

- Launched the first-ever green bank in the country in Michigan and continue to provide critical business operations support from payroll to launching a $100 million fund to invest directly into green projects

- Activated green banks in Illinois, Indiana, and Washington and continue to provide staffing and operational support

- Provided strategic advisory services and ongoing support for the Minnesota Climate Innovation Finance Authority

- Laid the groundwork with teams in Washington, D.C. and Louisville, Kentucky, to create new green banks

Let’s get started today.

Michigan Saves sprang from a 2009 grant through the Michigan Public Service Commission to create an innovative system for renewable energy financing and energy efficiency. One year later, Michigan Saves was incorporated as a 501(c)(3) nonprofit, led by a diverse board of directors. Once established, the board engaged PSC to staff the organization —a role we still play today — leveraging our expertise and history with Michigan Saves to provide steadfast management services in support of this flourishing green bank. Since its founding, Michigan Saves has delivered over $675 million in loan originations.

Turnkey solutions for green bank success

Whether you’re just starting out or scaling up, PSC offers end-to-end services and targeted support to help green banks and clean energy programs flourish. These services are all-inclusive or available a la carte.

Organizational development

- Draft incorporation documents and secure 501(c)(3) status

- Recruit a mission-driven board and support bylaw and governance policies development

- Create efficient organizational structures and define key roles

Comprehensive operations support

- Provide staffing, payroll, HR and tech support

- Manage accounting, insurance, internal controls and communications systems

- Oversee onboarding, mentoring and staff program management

Market analysis and strategic planning

- Conduct data-driven market assessments and financing gap analyses

- Engage stakeholders like municipalities, contractors, utilities and lenders

- Facilitate inclusive strategic planning with an actionable roadmap

Capital deployment and program design

- Develop financing strategies, design loan products and perform underwriting

- Analyze financial and technical feasibility

- Manage and evaluate investment portfolios to drive impact

Contractor recruitment and engagement

- Develop a reliable contractor network to drive demand

- Identify market gaps and expand program awareness

- Implement quality assurance protocols

Marketing and communications support

- Build a professional brand, website, and social media presence

- Launch marketing campaigns and public relations efforts

- Engage contractors, customers and communities through targeted messaging

Market analysis and strategic planning

- Conduct data-driven market assessments and financing gap analyses

- Engage stakeholders like municipalities, contractors, utilities and lenders

- Facilitate inclusive strategic planning with an actionable roadmap

Compliance and performance management

- Ensure regulatory alignment, and provide training for evolving laws, grants and financial regulations

- Support audits, state and federal reporting, and risk management

- Track key performance indicators to improve and scale programs

Fundraising

- Access to a strong network of mission-driven private funders with a proven track record of raising millions for operations and investment capital

- Expertly crafted state and federal funding proposals with multi-million dollar outcomes

- Collaborative green bank funding coalitions that increases access to larger or otherwise inaccessible funding opportunities

Green banks at work

In the absence of statewide public leadership on clean energy expansion, the McKinney Family Foundation convened clean energy focused foundations to develop a new green bank to drive clean energy and energy efficiency access and adoption in Indiana. They called on PSC to analyze the market and develop an actionable business plan.

In August 2023, PSC hired IEIF’s first executive director who has worked diligently to build out the organizational infrastructure and launch programs. IEIF partnered with the National Energy Improvement Fund in 2024 to launch a commercial clean energy finance program.

IEIF has been working to raise capital through competitive public grant opportunities and engagement with additional private funders. It successfully received $10 million from the Coalition for Green Capital in January 2025. IEIF will use its growing resources to launch new residential programming.

In 2021, Illinois set some of the most ambitious clean energy goals in the country with the passage of landmark legislation known as the Climate and Equitable Jobs Act. It provided seed funding and directed the creation of a new independent nonprofit green bank. Through this legislation, the Clean Energy Jobs and Justice Fund was created with the explicit responsibility of making clean energy financing available to underrepresented communities and minority-owned businesses.

Governor JB Pritzker appointed the first directors to the CEJJF board in 2023. This group engaged PSC to support ground-up organizational development and provide strategic counsel. Less than a year later, PSC hired their first executive director.

CEJJF initiated a market study that will identify current gaps in programming for underrepresented communities and workforce development tools for minority owned businesses. These findings will be used to develop new programming in the second half of 2025.

Following direction from Governor Jay Inslee to leverage federal clean energy funding from the Inflation Reduction Act to initiate the creation of a private nonprofit green bank, the Washington State Department of Commerce sought out PSC to provide organizational development support and strategic counsel. The City of Seattle partnered with the development team to fund a market scan to ground WA Green Bank in the most pressing statewide climate finance needs. This analysis will guide the strategic direction and program development for the new green bank.

PSC led the search and hired WA Green Bank’s first executive director (effective April 14, 2025) who will begin actively fundraising and building out programs in alignment with the findings of the market scan.

The WA Green Bank executive director will begin engaging communities and prospective partners to educate consumers on the value of climate financing programs with the goal of launching programs in 2026.

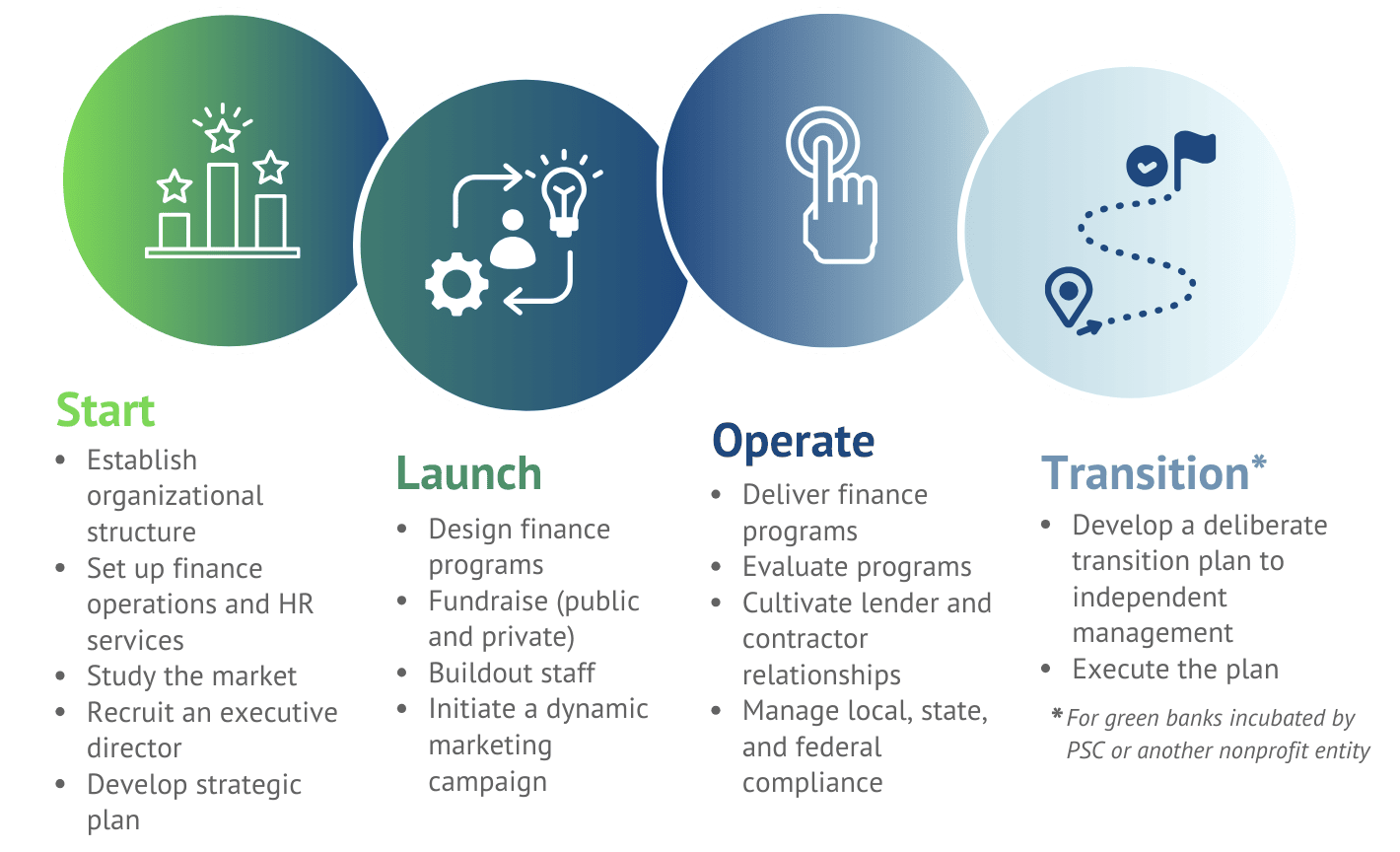

From startup to scale, we’ve got you covered

Every green bank goes through four key stages: start, launch, operate, and transition. No matter where you are in the process, PSC is ready to support you at every step. Our experience working with green banks in each phase means we are ready to dive in no matter where you are in the development cycle.

"PSC’s expertise moved us from vision to action. Their strategic guidance was instrumental in making our green bank a reality."

– Alex Crowley, Executive Director, Indiana Energy Independence Fund

Are you ready to plug in and play?

Power up with us.

"*" indicates required fields